New job reports were just released! Here’s our labor market insights for March 2025 written by Matt Duffy:

I’m an optimist. My wife recently told me that if our house was burning down my initial response would be – “great, we’ll finally get new furniture!” But I’m not a blind optimist; I understand there are generally three lenses in which we view things—optimism, pessimism, and realism. In terms of the labor market, I’ve downshifted from optimism to realism.

This past October, I referenced the labor market was at a bit of a tipping point. Here’s a snippet from that report:

Like two boxers squaring off in the ring, there are two data points that are in a stare down and will determine the answer to this question [the fate of the labor market] – those data points are hires and layoffs. I’ve been keeping a close eye on these two points over the last several months. Both are in a precarious position – and the health of the labor market rests in their hands.

In one corner, we have the hires rate, which has dropped to just 3.3%, comparable to 2013 levels. Don’t be fooled by the new jobs and job openings numbers, both are meaningless if companies aren’t actually hiring people. The lack of hiring across nearly every sector is highly concerning. In the other corner, we have layoffs, which are notably below historical standards. The layoff rate has been at ~1% in 2024; well below the 2010’s average. If the layoff rate increased to an “average percentage,” the unemployment rate would be pushing 5% (at least).

From October to today, we’ve seen a dip in the hiring rate and a slight increase in layoff activity. Let’s zoom into the Hire & Layoff rate numbers and trends:

Hire Rate:

- The U.S. is experiencing the lowest hiring rate (~3 – 3.4%) since 2007-2008 (coming out of the Great Recession).

- The last time hiring was this stagnant, unemployment was in the ~7-8% range.

Layoff Rate:

- Layoffs rose 245% in February compared to the previous month.

- 103% increase from a year ago.

- The U.S. cut more jobs last month than any previous month since 2019.

- More than one-third lost their jobs due to DOGE cuts.

- Retail saw ~39k cuts, technology firms cut another ~15k, and retail lost ~11k.

Regarding the DOGE cuts: recent DOGE-driven employment cuts had little-to-no impact on this month’s job report. That’s partly because of timing: the bulk of the layoffs didn’t occur until after the survey period (which is the week of the 12th). And those impacted likely won’t hit the unemployment radar for a few months. It’s more likely that federal cuts will be more visible in the March and April jobs reports.

The house isn’t on fire, and we should hold off on shopping for new furniture. Job growth, unemployment, and labor force participation numbers offer signs of hope. As an optimist, I believe in opportunity in the face of uncertainty—if so, there’s a lot of opportunity in front of us.

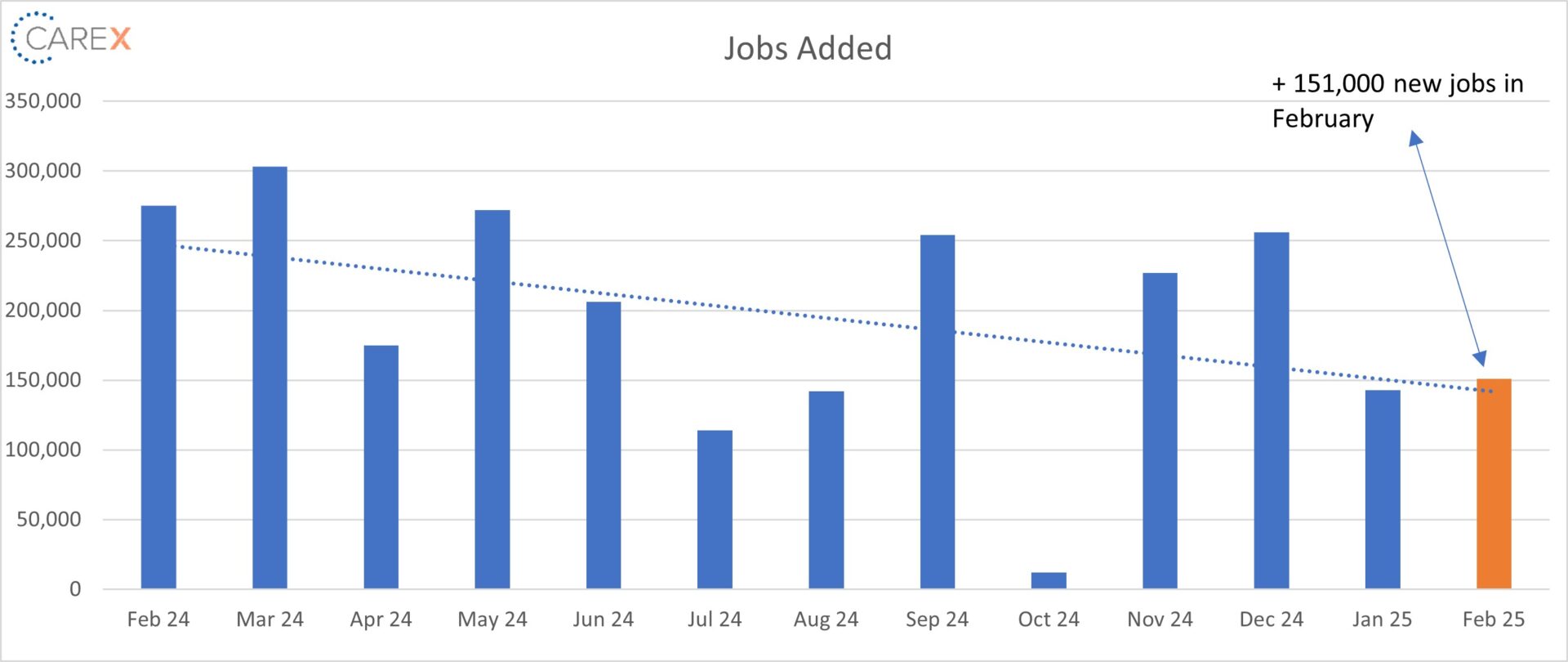

By the numbers:

- New Jobs – the U.S. added 151,000 new jobs in February.

- The healthcare sector added 52,000 roles in February, financial-services firms added 21,000, and transportation and warehousing companies added 18,000.

- Unemployment ticked up to 4.1%, up from 4% the previous month.

- The Fed anticipates it’ll hit 4.3% in 2025.

- The first time since 2021 unemployment has been at or above 4% for nine consecutive months.

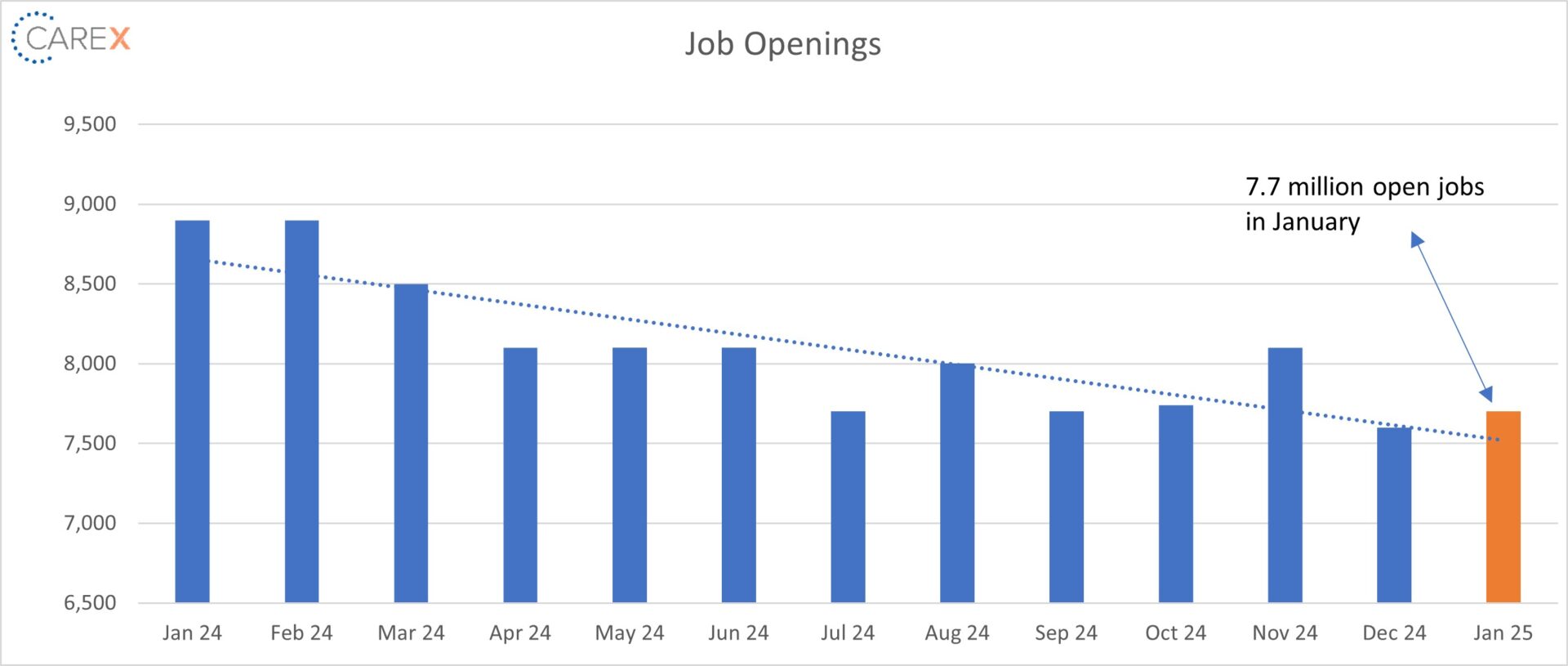

- Job openings increased slightly to 7.7 million, up from 7.6 million the previous month.

- The 5th consecutive month job openings were below 8 million.

- Job openings increased in real estate and rental and leasing (+46,000).

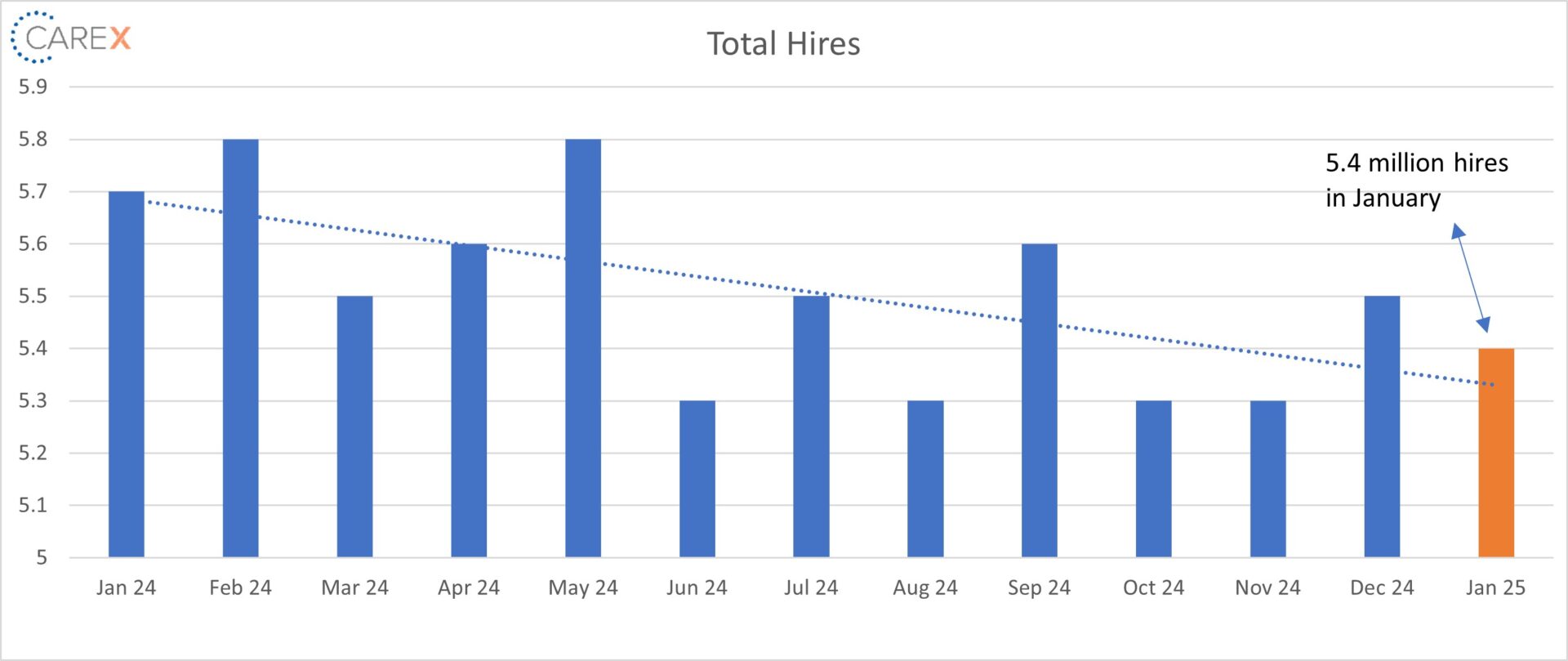

- Hires fell slightly to 5.4 million, down from 5.5 million last month.

- Down from 5.7 million this time last year.

- Layoffs dropped slightly to 1.6 million, down from 1.8 million last month.

- Cuts within the Federal Government did not fully show up in this month’s report (timing of the cuts and survey dates).

- Quits increased slightly to 3.3 million, up from 3.2 million the previous month.

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one, continue to remain very steady (and very low).

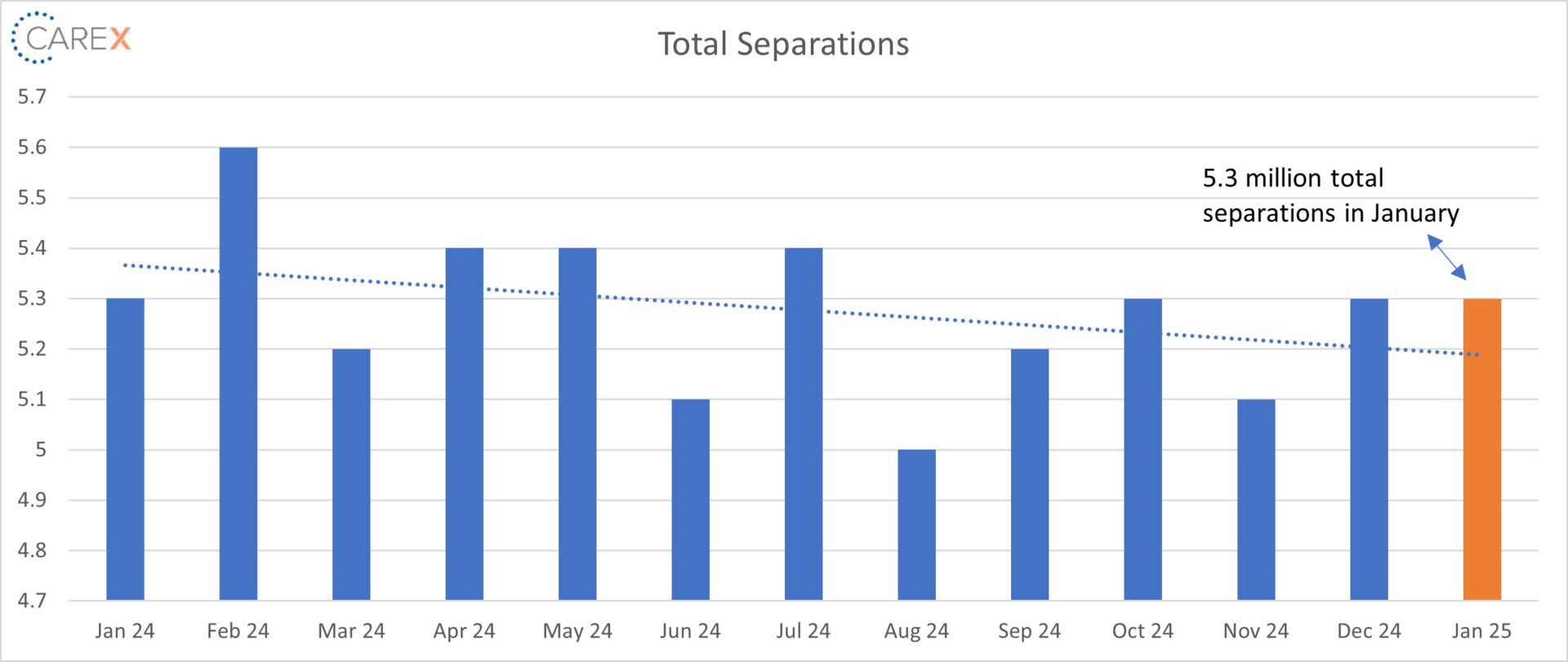

- Total separations remained steady at 5.3 million.

- Total separations have remained steady for the past 12 months.

- Jobs per available worker landed at 1.08:1, down slightly from 1.1:1 the previous month.

- Noticeably down from 1.8:1 this time last year.

- The ratio was 2:1 in 2022.

- Labor Force Participation Rate (LFPR) dropped slightly to 62.4%, down from 62.6% the previous month.

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email! While you’re here, make sure to check out the other resources we have available.