Authored by Matt Duffy, Vice President, Partner Success

As we kick off a new year, I’m getting a lot of questions on the economy and the labor market. Here is my response to the question: 2023: WTF is happening with the (1) labor market; (2) a possible recession; and (3) unemployment?

Most people agree we might be heading into a recession. Past recessions have created havoc with the labor market (jobs loss, unemployment, wages, etc.), and those of us in the field of “talent management/acquisition” are understandably paying attention. The “Big R” has been on the Federal Reserve’s radar for nearly a year. After several massive rate hikes, the Fed seems to be easing the pressure.

Enter the hope of a “Soft Landing,” which essentially means the economy will shift from high growth to slow—or no—growth as it approaches but avoids a recession. Specifically, we’ll avoid massive job loss, high unemployment, and wage stagnation typically associated with other recessionary periods.

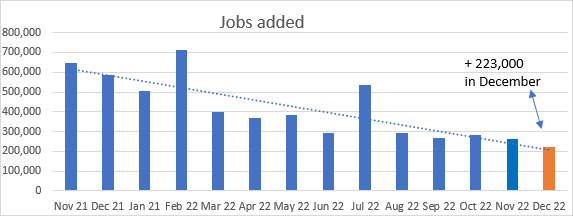

Hopes that the Fed can rein in elevated inflation without crashing the economy into recession were boosted by the December JOLTS (job and labor) report, which showed wage gains easing while unemployment dropped to historic lows (the lowest rate since 1969). Inflation slowed to 6.5% in the 12 months ending in December, and the Bureau of Labor Statistics (BLS) reported that the economy added 223,000 more jobs in December. The strong jobs report coupled with the continued high rate of job openings is a positive sign. As a share of the labor force, job openings remained at 6.4%, indicating demand for workers is still high despite the Fed’s efforts to cool the economy and bring down inflation.

In addition to months of strong job creation, the prospects for the next few months look good, as the number of people applying for jobless claims each week (a forward-looking indicator of the labor market weakening) also shows no evidence of seriously increasing. Last week, jobless claims were at 205,000, a decline from the most recent peak of 261,000 last July.

So, are we heading to a soft landing? I don’t know…but I think so. My response to the aforementioned questions about the economy and the labor market is:

“Even with an uncertain economy and the possibility of a recession, I think we’re headed for a soft landing, and the labor market will remain very strong.”

Here are 3 reasons why:

- Job Growth & Quits

- The Beveridge Curve

- Labor Force Participation Rate

Job Growth and Quits

- The US continues to add jobs at an incredibly high rate. Last month we added 223,000 new jobs (that was the lowest increase in all of 2022).

- The quit rate has been above 4 million for 18 straight months, after coming in at 3.4 million before the pandemic and averaging 2.6 million in the prior years.

- Even with the Fed’s aggressive action, companies are continuing to create jobs, and employees continue to feel confident in the market.

- Essentially, this is corporate America (and its employees) giving the middle finger to the Fed; after twelve months of both parties flipping the bird to inflation hikes, I sense both are on fairly solid footing.

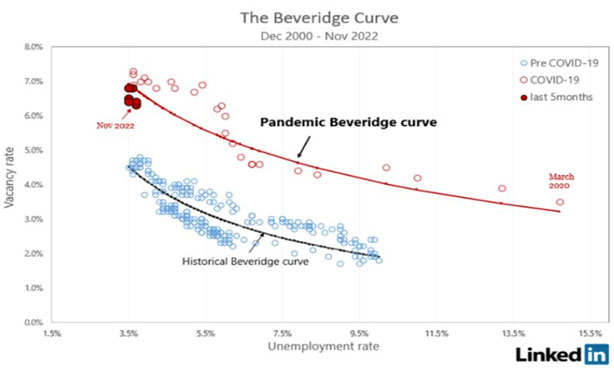

The Beveridge Curve

The Beveridge Curve

- The Beveridge curve refers to the observed statistical relationship between the level of unemployment and the number of open job vacancies. Like dance partners, these two data points typically move together, telling a consistent—and clear—picture of what’s happening in the labor market. What the Beveridge curve tells us is that when you reduce vacancies, the unemployment rate is going to go up.

- In good times, what economists call “expansionary periods,” job vacancies tend to be high—the labor market moves up the steep side of the Beveridge curve. In recessions, when unemployment is high, there are typically fewer open jobs, and it slides back down.

- But when we look at the current period and the steepness of the curve, even if we see a decrease in job vacancies in the future, it’s not going to have such a drastic impact on unemployment.

- If we look at the above “Jobs Added” graph, we see a steady decline in jobs created (note the trend line); however, we’re not seeing a significant increase in unemployment. In fact, unemployment dropped to 3.5% last month (back to its low point prior to the pandemic).

The Labor Force Participation Rate

The Labor Force Participation Rate

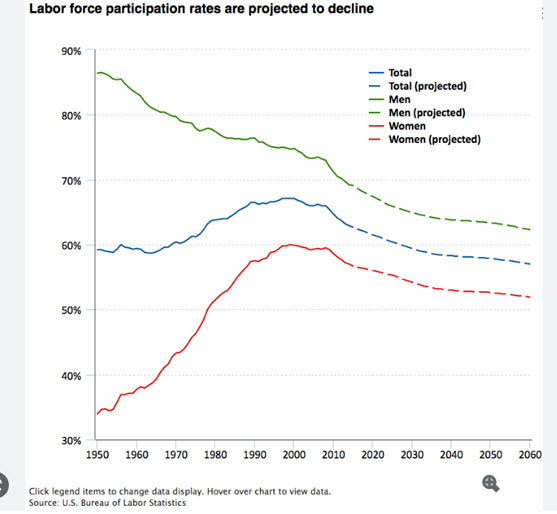

- If we continue to add jobs at the current pace (or even at a much slower pace), where, exactly, are the workers going to come from?

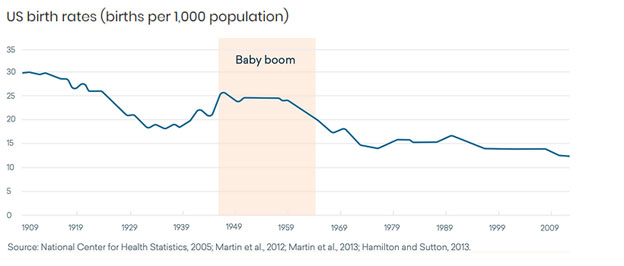

- The working age population stopped growing. The Baby Boomers are mostly retired, and we’re not replacing them in the labor market (in the early 1970’s we stopped having enough babies). Since coming out of the pandemic, the labor force participation rate hasn’t budged; in fact, it continues to decrease. Long term trends also paint a very bleak picture—marriage rates are low, which correlate with lower birth rates (read: the labor force participation rate won’t change for decades).

- With a historically low unemployment rate, consistent job creation (even at a moderate level) and a historically low LFPR, I’m not certain past recession pitfalls will greatly impact the labor market.

If you want more Labor Market Insights, subscribe to our monthly newsletter! And as always, we’re happy to answer any questions directly—just give us a shout!