By: Drew Schroeder

Four years ago, I started buying Bitcoin and had absolutely no clue what I was doing. I simply saw the price “going to the moon” and decided maybe I should try and get some. I had no knowledge of the fundamentals of Bitcoin or why I was investing. Like many others, I was swept up in the mania. However, as someone who has always had a passive interest in investing, it gave me an excuse to do my own research and by doing so I gave myself a crash course in economics, monetary policy, and why Bitcoin will continue to be a part of my investment portfolio. I think it’s always important to consider alternative opinions and not get stuck in groupthink. People were spending money on this, and I wanted to know why!

To be clear, this is not investment advice, simply the perspective of a “normal guy” who went down the Bitcoin rabbit hole in 2017.

When first considering the idea of Bitcoin, it’s easy to brush it off as magic internet money that will never catch on. Why does something like this have value? Anything that challenges the status quo can be hard to grasp. The reality is that societal transforming ideas are always seen as crazy…until they’re not. Then we can’t imagine what our day-to-day lives would look like without them! Take for example this anti-electricity cartoon from the early 1900s and quote from Nobel Prize-winning economist Paul Krugman as it relates to the internet back in 1998:

After I allowed myself to be open to the idea of Bitcoin, one of the next steps was to determine why it could be important to me and worthy of investing my hard-earned money toward it. Is it simply speculative, or are there underlying fundamentals that make it worthy of holding long term? After many hours of reading and podcasts, the simple conclusion that I came to is that it’s an incredible store of value, while also having once in a lifetime asymmetric upside. Pretty good combination!

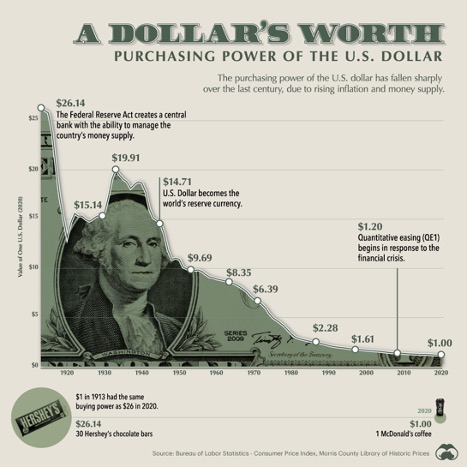

In more recent history, it has also been called a hedge against inflation, which is correlated with the store of value statement. We can see from the image below that since the creation of the Federal Reserve, the purchasing power of the US Dollar has decreased dramatically.

The ability of a centralized entity (Federal Reserve) to create new money when it’s deemed necessary causes a devaluation of the currency, while also having an inflationary effect on the prices of many goods, creating less purchasing power. In essence, our money is worth less, and things continually get more expensive. A troubling double whammy!

The incentive to save money in traditional savings accounts is less than ideal when looking through this lens. The minuscule yield rates along with the devaluation simply can’t keep up with the rate of inflation, which can make your savings feel like a melting ice cube. While the number in the account may not change, what it is able to buy you in the real world changes.

Where Bitcoin differs is that there is no central entity that can manipulate the supply. Unlike things like gold and paper currency, the supply is finite and pre-programmed (21 million). The market decides the value, nothing else.

While many point to Bitcoin’s volatility as a negative, which is very common in a nascent asset (only 12 years old), it has an average annual return rate of 200% since inception, and if you look at the year over year price chart, it has an “up and to the right” path of price discovery. A stark contrast to the “down and to the right” chart of the purchasing power of the US Dollar, which is why I’ll again refer to the store of value reference (protects purchasing power), and asymmetric upside (200% AAGR) thesis.

As more and more people adopt Bitcoin, network effects kick in and positively impact value. There will only ever be 21 million Bitcoin on a planet that has almost 8 billion people, so the supply squeeze will only get tighter. This is also a good time to stress that you can purchase fractions of Bitcoin. Don’t fall victim to unit bias and think it’s a whole Bitcoin or nothing! It’s a common misconception, but it’s no different than purchasing fractional stock shares. Nobody is priced out.

In circling back to the volatility argument, there is one piece of relatable information I found very interesting about a well-known company – Amazon. Amazon stock has had 8 separate events of a 50% or greater crash in stock price since it became public. I’d wager that most view Amazon as a sound investment now. Early adopters reaped larger rewards (if they held), but it is still viewed as a wise investment despite the high price tag and is included in many retirement accounts and portfolios. Increased adoption = less volatility.

People all over the world can tap into this network with an internet connection and a smartphone. The number of active users continues to grow, and institutions (Tesla, Square, Microstrategy) are starting to take notice and are taking the cash that continues to be devalued over time on their balance sheets to purchase and add Bitcoin to their corporate treasuries. Impressively, it is the fastest asset to reach a $1 trillion market cap, and El Salvador recently became the first nation-state to adopt Bitcoin as legal tender!

For an asset that was worth less than a penny when created, it has come a long way in a short amount of time. Amazingly, it is still in the very early stages of adoption with an estimated 1% of the world owning Bitcoin. A fun way to think about it is that in terms of adoption rate, Bitcoin has roughly the same users as the internet in 1997, but it’s growing much faster. In the next 4 years, the current path will bring users to 1 billion people, which would be the equivalent of 2005 for the internet (see below).

I could go on about the merits of adding a percentage of Bitcoin into your portfolio strategy, but as I referenced in the beginning, the best way I learned was through doing my own research and coming to my own conclusions. Below are two books that greatly helped me if you’re wanting to go down your own rabbit hole:

The Bullish Case for Bitcoin by Vijay Boyapati

Bitcoin: Hard Money You Can’t F*ck With by Jason A. Williams