The BLS and JOLTS report was just released! Below is an overview of the key data points and our summary of the state of the labor market for April 2023.

Key Takeaways:

- There’s a lot of hyperbole about “labor market uncertainty”—there is no uncertainty about it, the labor market is cooling. This month’s data might even be construed as a “good jobs report” (positive job creation, low unemployment, wage stabilization), but it’s the trends that paint a more accurate picture—job creation, hires, and openings are all falling. A cooling market doesn’t mean it’ll turn “cold,” but we can’t ignore the trend lines.

- Warning: stepping up on my cynical soap box—job openings have dropped, but I think they are still overinflated. My sense is that many active openings aren’t actually “active.” Many listed job postings are either old, closed/filled but not taken down, or used as “pipelining” (hiring for the future). Not only does this practice create an inaccurate data set, but it’s also insanely frustrating to job seekers.

- Employers added jobs last month in leisure and hospitality, government, professional and business services, and health care. They cut jobs in construction, manufacturing, and retail.

- Weekly jobless claims, a proxy for layoffs, have risen from historic lows and job openings have declined, in signs of easing demand for workers as the labor market gradually cools.

- Small and medium-sized businesses, who have been the drivers of job growth, accounted for most of the decrease, with establishments with 1,000 workers and more reporting a small reduction in job openings.

- Despite high-profile job cuts in the tech sector, layoffs overall have been historically low, a sign that employers may be reluctant to part with workers hired during pandemic-era spikes.

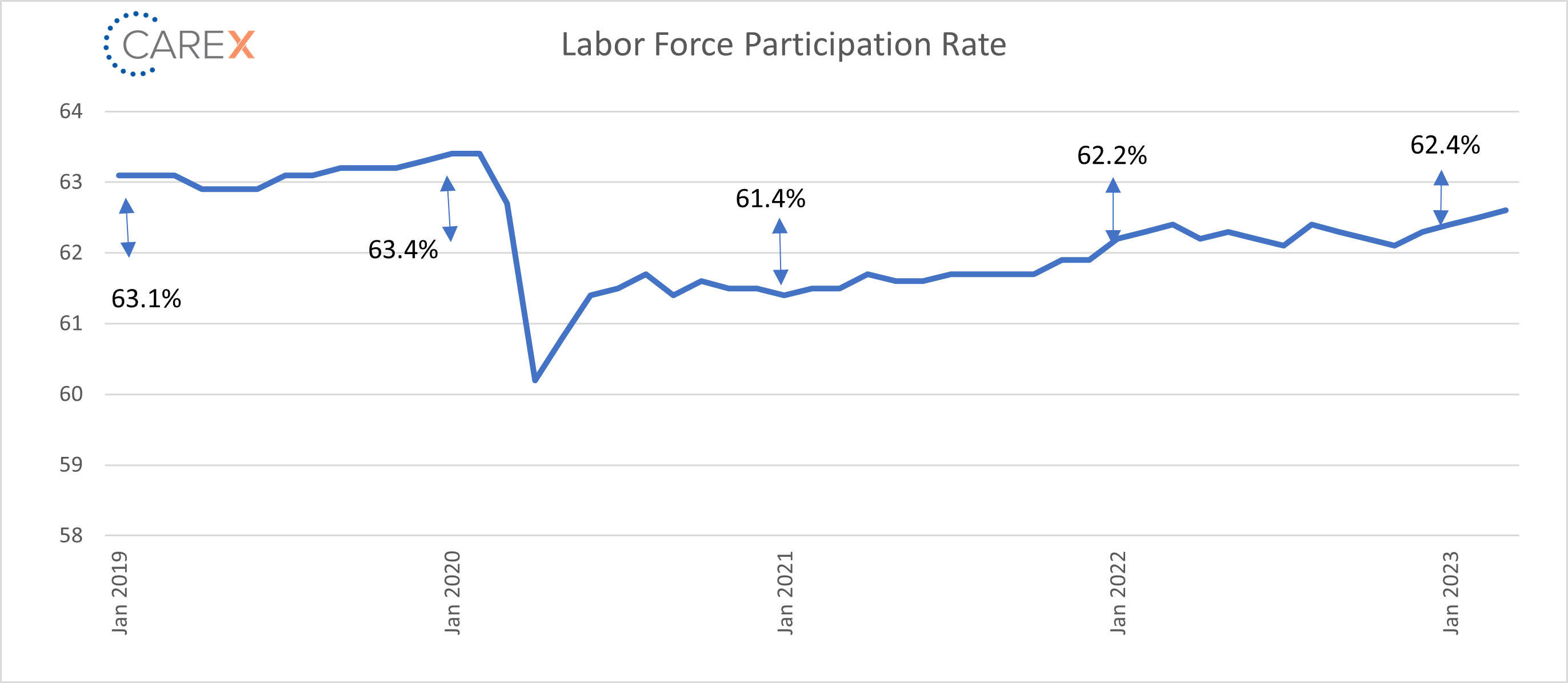

- Some encouraging news: the LFPR continues to edge higher, indicating people are coming off the sidelines and re-entering the workforce (the highest it’s been since the pandemic started in early 2020).

By the numbers:

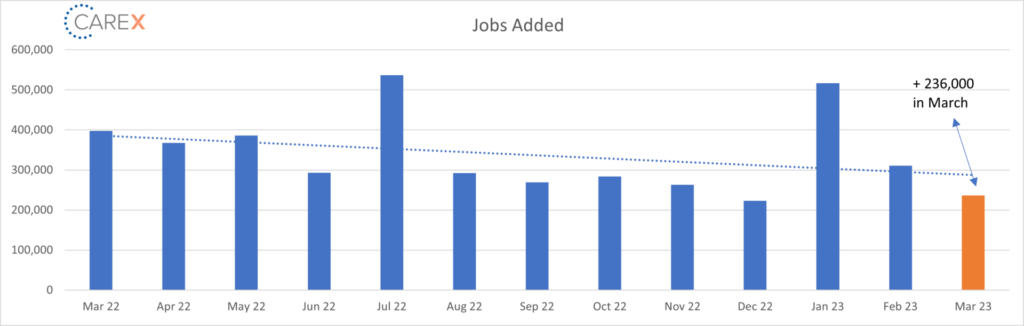

- New Jobs – The U.S. added 236,000 jobs last month—this is a sharp decline from two months ago (517,000 new jobs) and last month’s rate of 311,000 new jobs (chart above).

- Unemployment eased to 3.5%, down from 3.6% the previous month.

- Wages were up 0.3% on the month.

- On a year-on-year basis, wages were up 4.2%, compared to the 4.6% pace recorded in February.

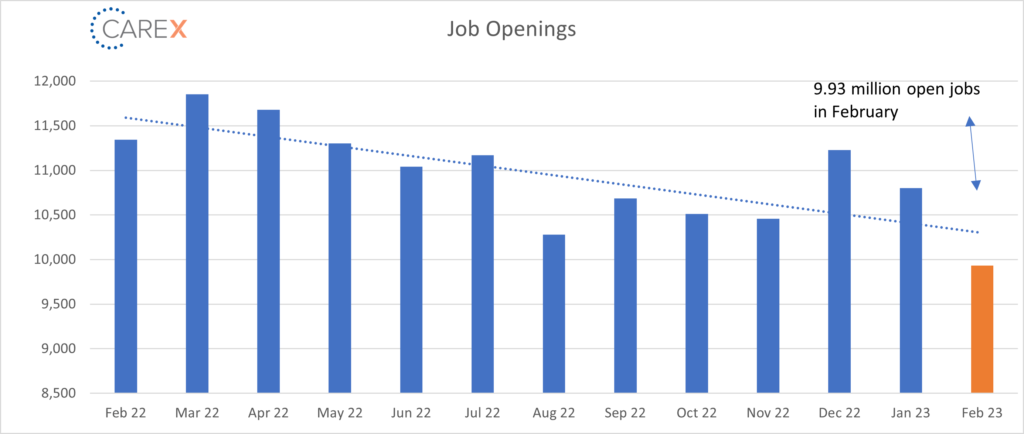

- Job openings decreased to 9.93 million, a drop of 632,000 from the previous month (chart above).

- This is a significant decline after 20 straight months of jobs eclipsing the 10 million mark.

- It’s also well below economists’ estimate of 10.4 million.

- Professional and business services saw a slide of 278,000 job openings on the month to lead decliners.

- This is a sign that the Federal Reserve’s efforts to slow the labor market may be having some impact.

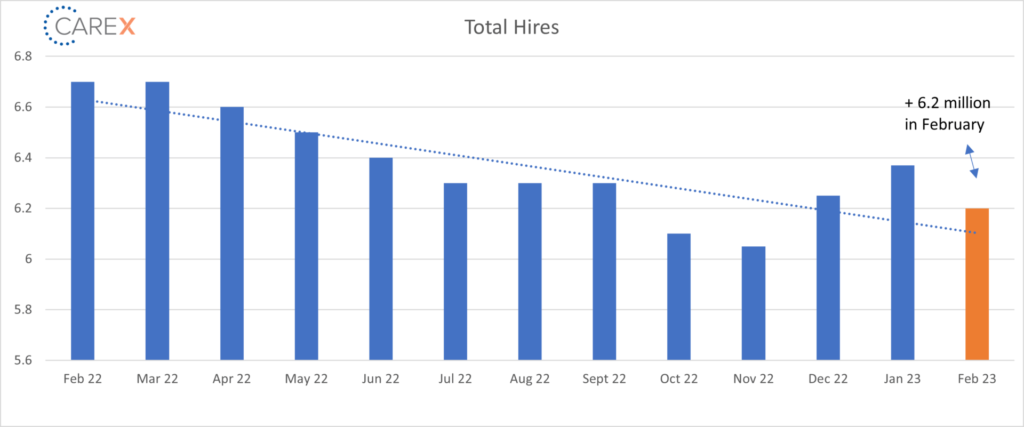

- Hires fell to 6.2 million, a drop from 6.3 the previous month (chart above).

- This isn’t surprising given the continual drop in job openings over the past several months.

- It’s likely this number will continue to edge down as job openings and new jobs created start to normalize.

- Layoffs dropped 215,000 to 1.5 million, down from 1.72 million the previous month.

- The steady rate of layoffs suggests that the period of unprecedented job security may be coming to a close.

- Quits – The number of people quitting their job rose to 4 million, up from 3.89 million the previous month.

- While still historically high, it’s below the record 4.5 million quits in November 2021 (it was 3.4 million before the pandemic and averaging 2.6 million in the prior years).

- The majority of quits were mostly coming from small businesses.

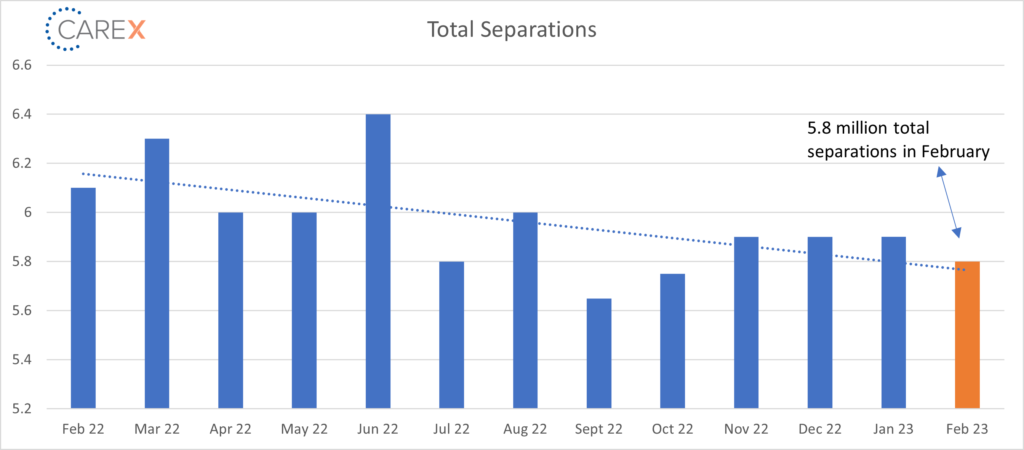

- Total separations remain largely unchanged at 5.8 million, down from 5.9 million the previous month (chart above).

- Initial jobless claims, another gauge of layoffs, have remained low, but that may not capture the full picture if workers receiving severance packages haven’t yet filed for unemployment insurance.

- Jobs per available worker dropped to 1.7:1 from 1.9:1 the previous month.

- There are around 5.9 million unemployed Americans.

- This is a definitive sign that the labor market continues to cool, which will likely keep wages low and start to curb voluntary quits.

- Pre-pandemic this number was ~1.2:1.

- LFPR (labor force participation rate) edged a bit higher to 62.6%, up from 62.5% the previous month.

- This is the highest since the pandemic started in early 2020 but still leaves it well below the pre-COVID level of 63.4%.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive these updates via email here! And while you’re here, make sure to check out the other resources we have available.