The BLS and JOLTS report was just released! Below is a summary of the key data points and our summary of the state of the labor market for February 2023.

Key take aways:

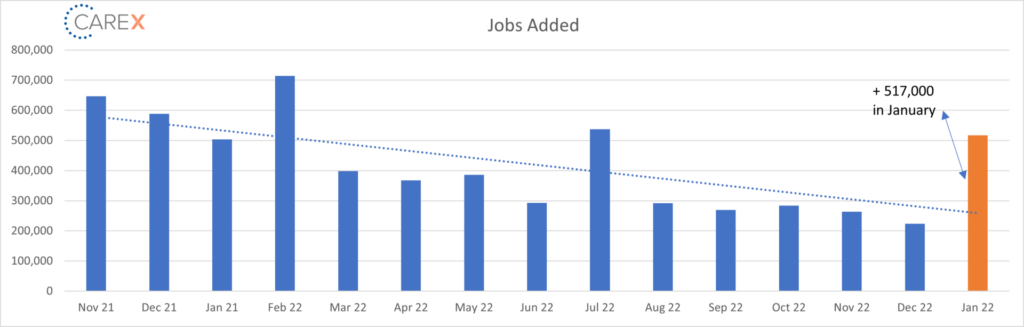

- The US added 517,000 new jobs—this is a jaw dropping number (Aaron Rodgers transferring to the Bears would have been less shocking). It showcases the strength of the economy and reinforces the nearly impossible task of anticipating how the Fed’s action will impact the labor market.

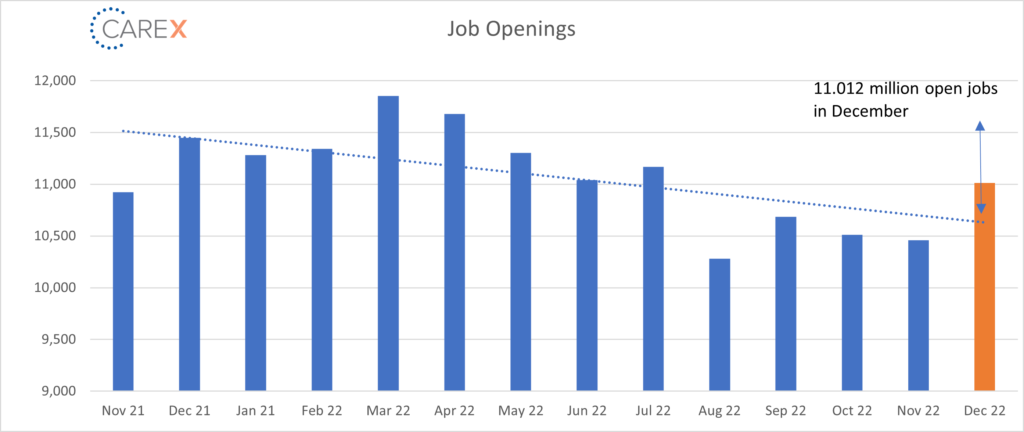

- The fact the rate of open jobs per unemployed worker rose to 1.9:1 is a strong indicator that there’s still a strong demand for workers and the labor market is still very tight—perhaps too tight for the Fed’s liking.

- The 5.5 percent increase in job openings was largely driven by hotels and restaurants, which have been steadily recovering from the pandemic. However, the job market overall is still surprisingly resilient.

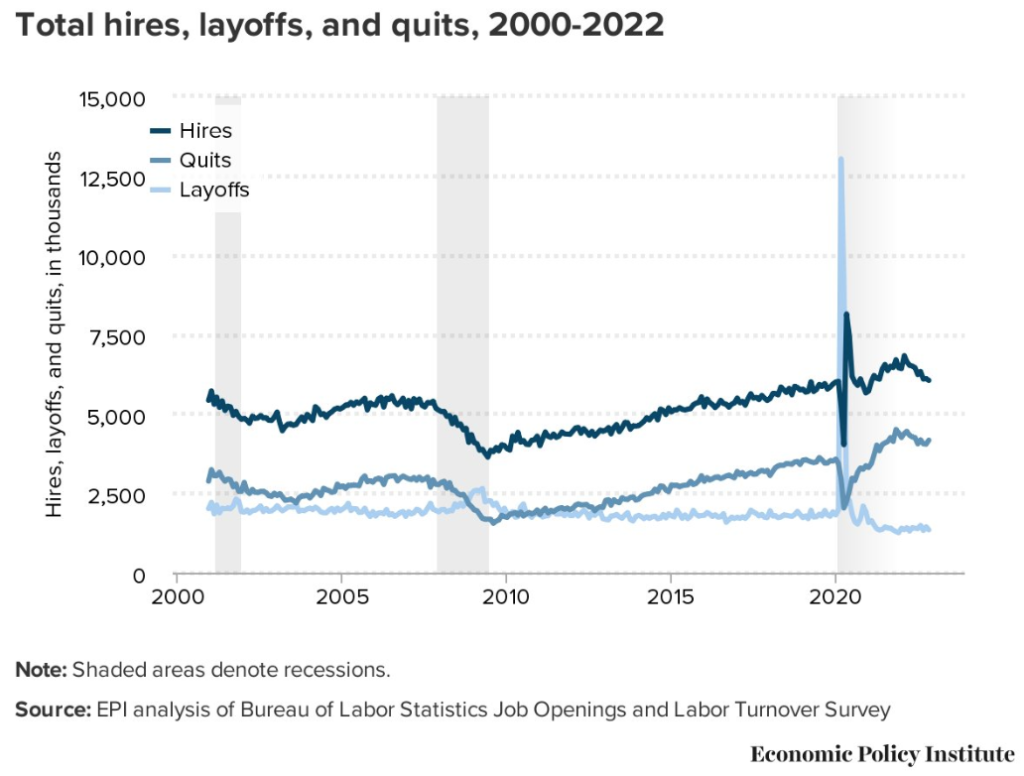

- Despite the headlines in the tech sector, layoffs were steady in December, staying at the unusually low level that has prevailed since a spike during the pandemic.

- Unemployment claims are also declining, dropping to 183,000 from 186,000 the week before. The report serves as a proxy for layoffs, meaning that companies are choosing to hang onto their workers despite ongoing recessionary concerns.

- Wage growth remains high (although decreasing) but is not keeping pace with inflation.

By the numbers:

- New Jobs – The U.S. added 517,000 new jobs (chart below)

- This number is truly shocking—not only did it more than double last month’s growth, it shattered the anticipated job growth of 187,000.

- This is an average monthly gain of 356,000 over the past 3 months.

- Unemployment fell to 3.4%, down from 3.5% the previous month.

- Below the estimate of 3.6%.

- This is the lowest rate since 1969 (not since the moon landing have Americans seen unemployment at this rate!).

- Wages – Average hourly earnings decreased to 4.49%, down from 4.87% the previous month.

- Job openings increased by 572,000 to a five-month high of 11.0 million (chart below).

- There have been at least 10 million job openings for 18 consecutive months, which have far surpassed the number of unemployed people who are looking for work.

- The number of openings once again exceeded economists’ estimates that projected 10.3 million openings.

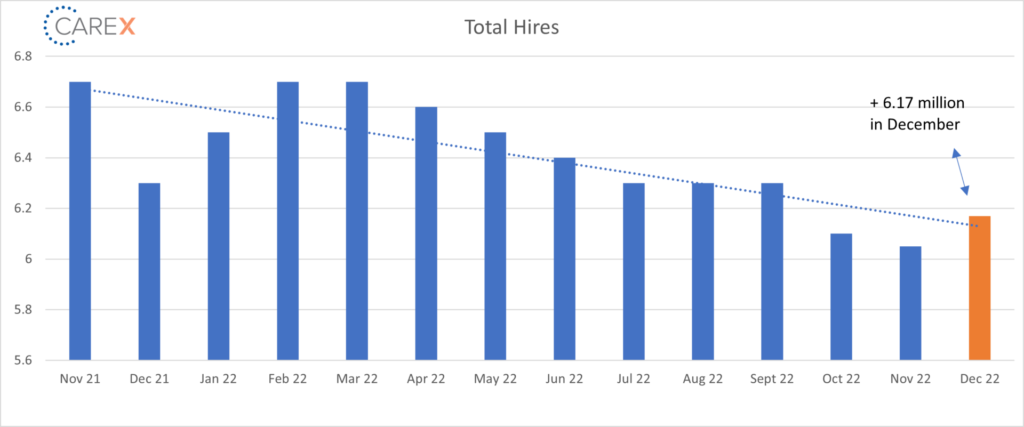

- Hires increased to 6.17 million from 6.03 million the previous month (chart below).

- Layoffs increased to 1.47 million, up from 1.41 million the previous month.

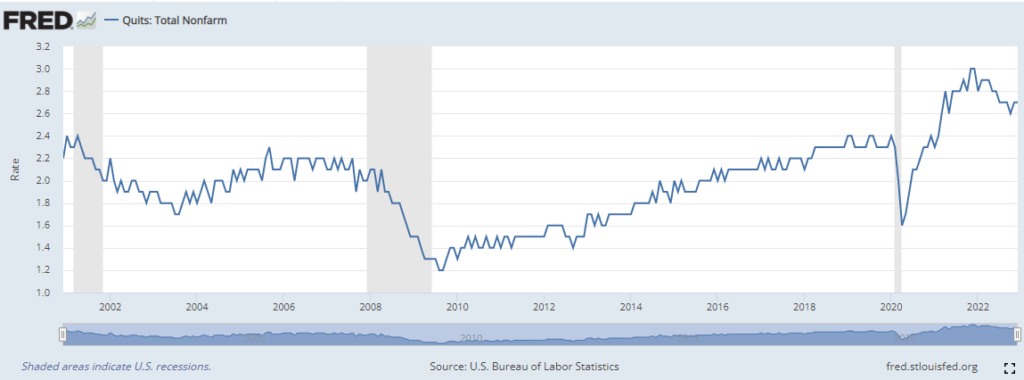

- Quits – The number of people quitting their jobs fell to 4.09 million, down from 4.1 million the previous month (chart below).

- The quit rate has been above 4 million for 19 straight months, after coming in at 3.4 million before the pandemic and averaging 2.6 million in the prior years.

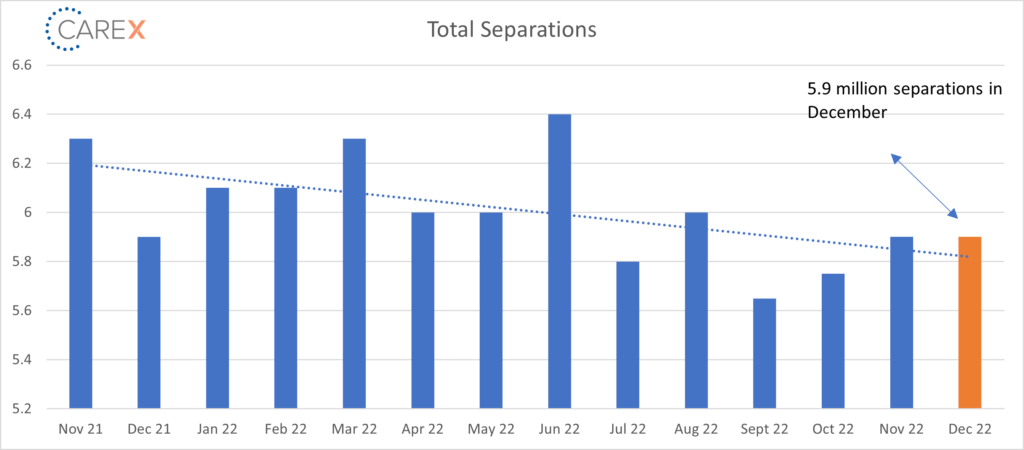

- Total separations remain unchanged at 5.9 million (chart below).

- Jobs per available worker increased to 1.9:1, up from 1.7:1 the previous month.

- Not what the Federal Reserve has been hoping for as it seeks to quell inflation.

- Pre-pandemic this number was ~1.2:1.

- According to Anna Wong, an economist with Bloomberg, “The ratio of job openings to unemployed is one of the most closely watched labor market metrics for the Fed—and it’s moving in the wrong direction. While wage growth might be slowing, it’s not clear it’s decelerating to a level consistent with the Fed’s price target.”

- LFPR (labor force participation rate) – The LFPR edged a bit higher to 62.4%.

- This is still below the pre-pandemic rate of 63.3% set in February of 2020. That works out to about 1.5 – 2 million missing workers in an environment with 11 million openings.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.