New job reports were just released! Here’s our labor market insights for February 2025 written by Matt Duffy:

If I had a nickel for every time I was asked “how is the labor market?”, I wouldn’t be rich, but I’d stop complaining about the cost of Starbucks. When asked about the labor market, I typically give a long and meandering response that rarely answers the actual question. For the foreseeable future, I’ve refined my answer to three words: “fine, but vulnerable.” Most of the key indicators support the first word: “fine” (4% unemployment is surprisingly low, job growth remains robust, separations remain very low, etc.). However, the indicator I pay the most attention to—the hiring rate—makes me include the final two words: “but vulnerable.”

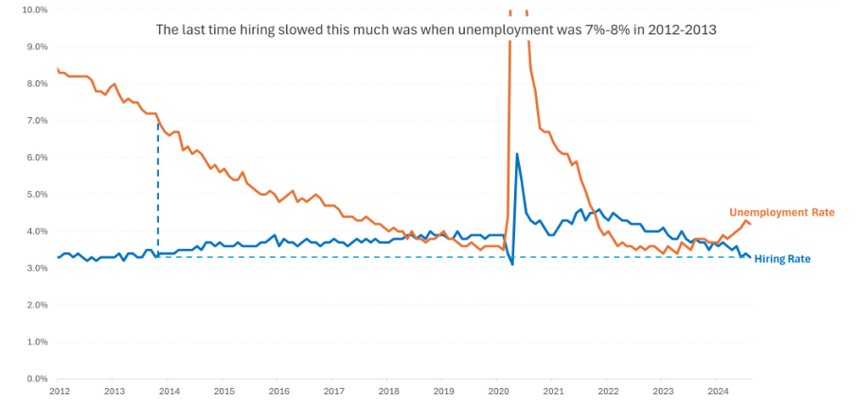

Job growth and job openings are interesting data points, but they’re meaningless if companies aren’t actually hiring people. The hiring rate measures how many workers are being hired into the labor market (current rate is 3.4%, which is concerningly low). As I’ve said before, history doesn’t repeat itself, but it rhymes. So, let’s put this number in historical perspective. The last time we saw a hiring rate this low was in 2013. During that time, unemployment was nearly double compared to today’s rate. Also, preceding that time—the great recession—hiring fell 1.3 points. The decline in hiring we’re seeing now is eerily similar.

It feels like we’re standing on the edge of a cliff with a strong wind at our back. However, even though vulnerability is a piece of story, I remain optimistic. The fact we’ve been able to keep unemployment under control with such a low hiring rate leads me to believe the underlying indicators are strong enough to weather the storm. Additionally, we’re seeing a softening in the Business and Professional Services sector (an area hit hard in 2024), which will likely provide more stability across the board. And finally, anecdotally, we (at Carex) are seeing a significant uptick in hiring at our Partners. It’s not overly scientific, but it feels like the pendulum is swinging in the right direction.

By the numbers:

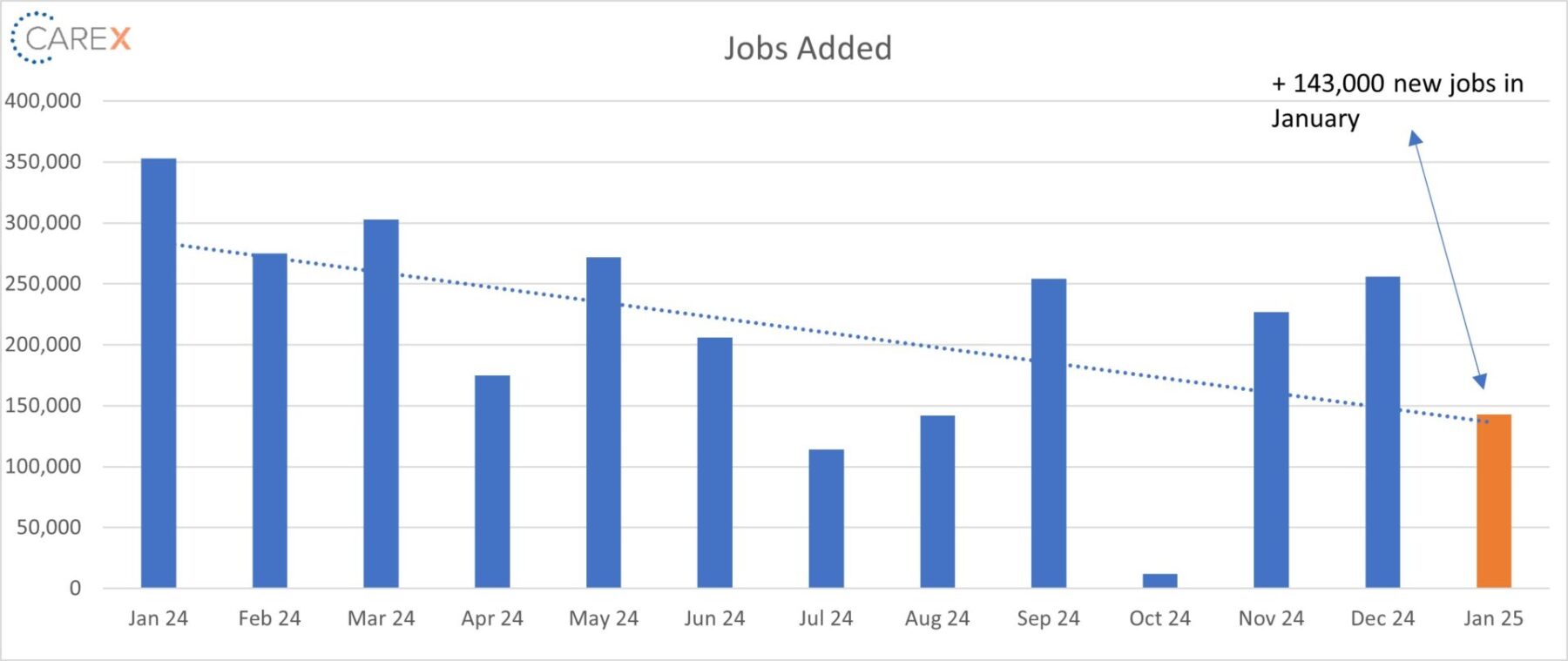

- New Jobs – the U.S. added 143,000 new jobs in January.

- Healthcare and Social Assistance and Government account for nearly 70% of January’s job gains.

- Job gains for the previous two months were revised up by 100,000, depicting an even more robust picture of the labor market at the end of 2024.

- Unemployment fell to 4%, down from 4.1% the previous month.

- The Fed anticipates it’ll hit 4.3% in 2025.

- The first time since 2021 that unemployment has been at or above 4% for eight consecutive months.

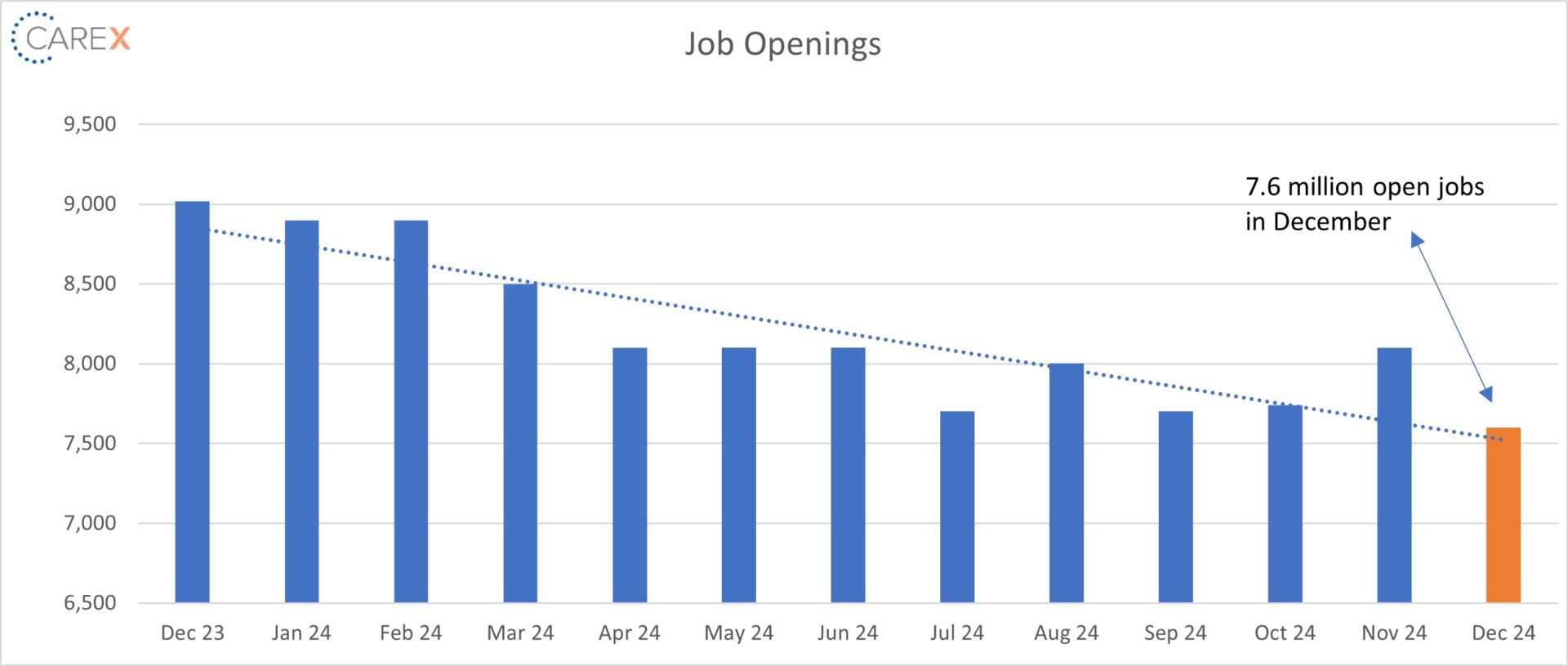

- Job openings fell to 7.6 million, down from 8.1 million the previous month.

- Job openings exceeded 8 million in 8 out of the 12 months in 2024.

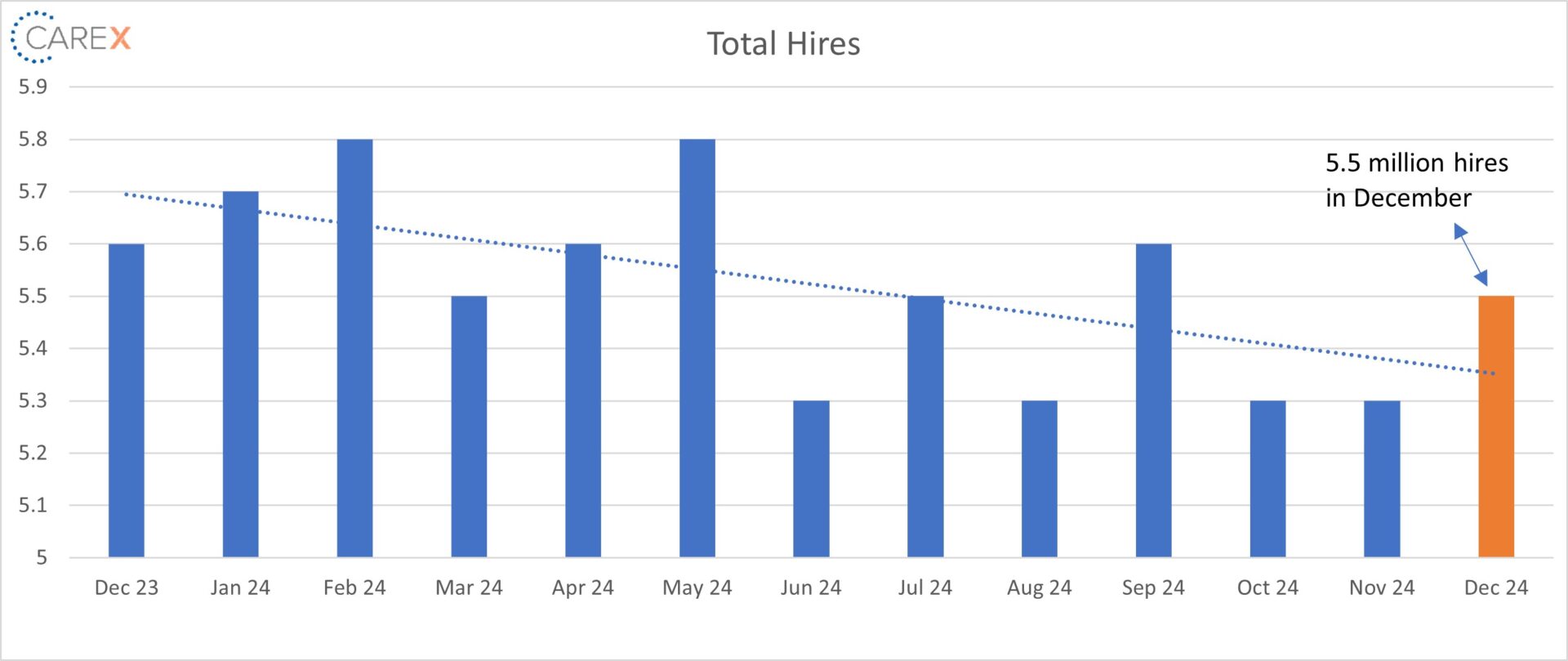

- Hires ticked up slightly to 5.5 million, slightly higher than the previous month of 5.3 million, but down from 5.6 million three months ago.

- Down from 6~ million this time last year.

- Layoffs remained unchanged at 1.8 million, up from 1.6 million three months ago.

- The layoff rate has stayed at ~1% for 15 consecutive months.

- The number of layoffs remains very low by historical standards.

- Quits increased slightly to 3.2 million, up from 3.1 million the previous month.

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one, continue to remain very steady (and very low).

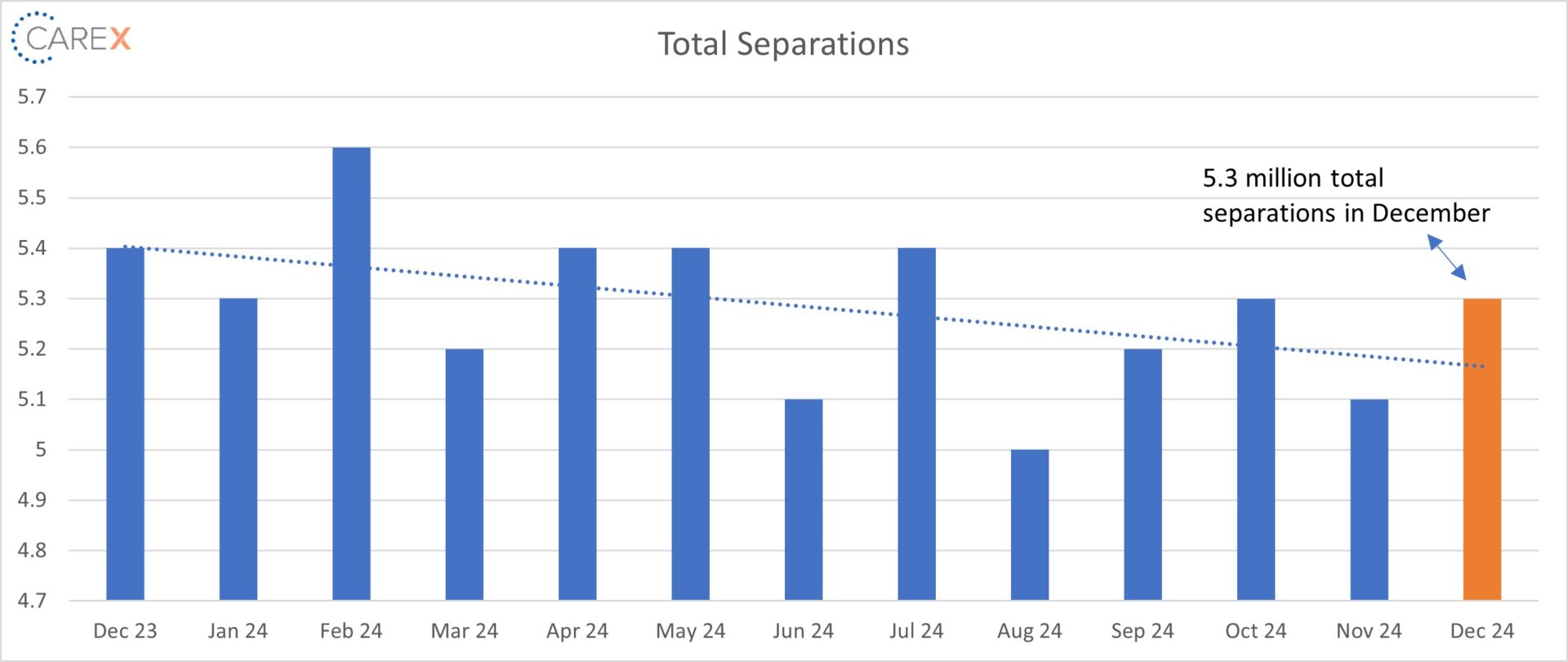

- Total separations increased to 5.3 million, up from 5.1 million the previous month.

- Overall, in 2024 separations have stabilized across all industries, notably the tech sector.

- Jobs per available worker held steady for the fourth consecutive month at 1.1:1.

- Noticeably down from 1.8:1 this time last year.

- The ratio was 2:1 in 2022.

- Labor Force Participation Rate (LFPR) increased slightly to 62.6%, up from 62.5% the previous three months.

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email! While you’re here, make sure to check out the other resources we have available.