New job reports were just released! Here’s our labor market insights for January 2025 written by Matt Duffy:

2024 is in the rearview mirror. In terms of the labor market, I’d venture to guess a large percentage of people reading this are happy to turn the page. The 2024 labor market felt rough. But was it? A few months ago, I had a glass of Glenfiddich 30-Year-Old Single Malt Scotch Whiskey. It was great. Since then, every other whiskey has tasted second rate. Were they bad, or was my recent experience with something amazing ruining it? It begs the question, was 2024 as rough as it felt, or was the highwater mark of 2022 (by all accounts, one of the strongest labor markets on record) skewing our expectations and reality?

Confusing—and often conflicting—job headlines bolstering the strength of the labor market mask what a lot of business leaders, HR, and job seekers are feeling. While we’ve avoided widespread job losses, hiring volumes have slowed, and job growth has been limited to just three sectors (Government, Healthcare, and Leisure & Hospitality accounted for nearly two-thirds of all new jobs created in 2024).

Twain had it right, “history doesn’t repeat itself, but it often rhymes.” While the details, circumstances, settings, and data may change, similar events will essentially recycle. I think it’s important to highlight how dramatically the labor market landscape has shifted over the past three years. And how that small sample size might help forecast what lies ahead.

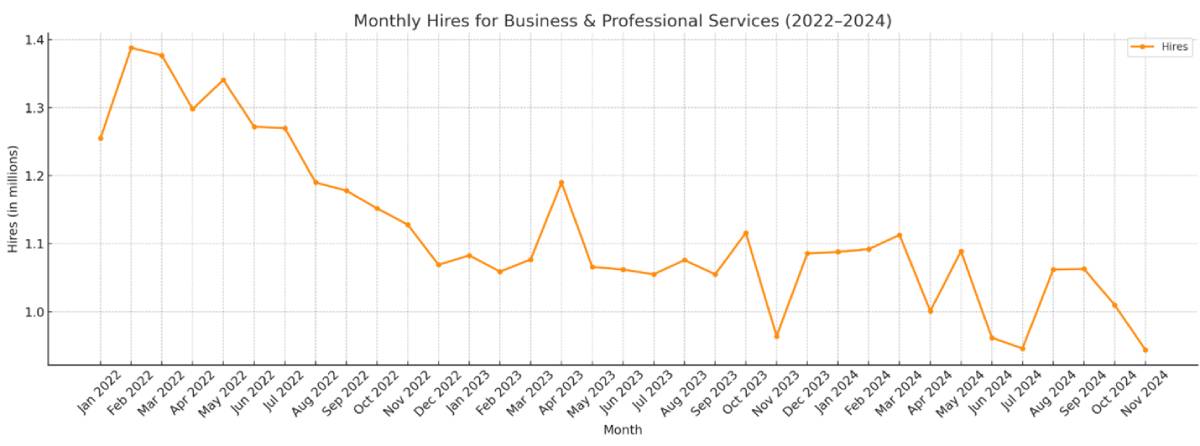

Let’s take a quick look at how the market has changed since 2022. As a barometer of how different industries were impacted, I’ve included data for all industries and standalone data for “Business & Professional Services” (which captures a large percentage of professional and technical services roles). I’ve said it a thousand times, but your view of the economy/labor market is massively impacted by the lens in which you view it. The below data might read very differently if we broke out specific roles, sectors, and even geographies that impact you personally and/or professionally (which I’m happy to do—just ask!).

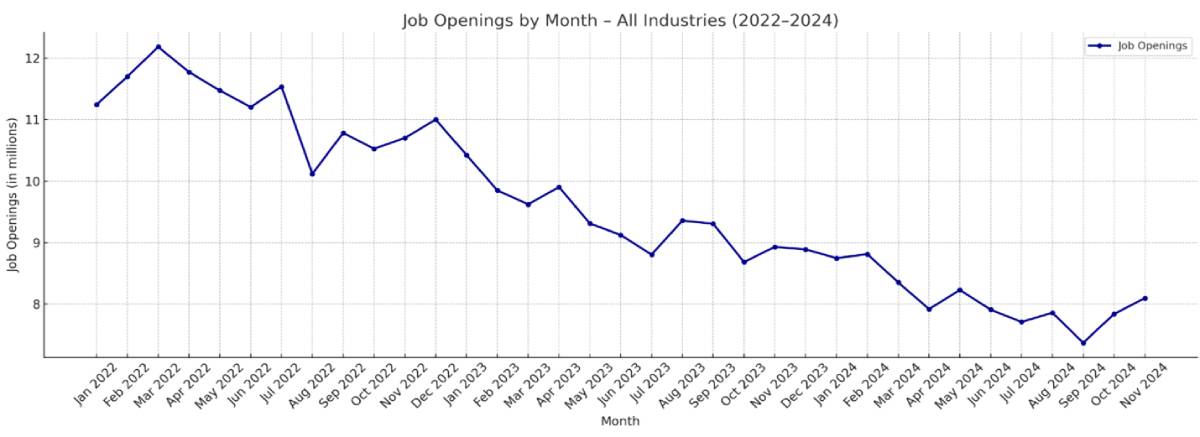

First, let’s look at the number of total job openings from 2022 to today.

And now, total hires:

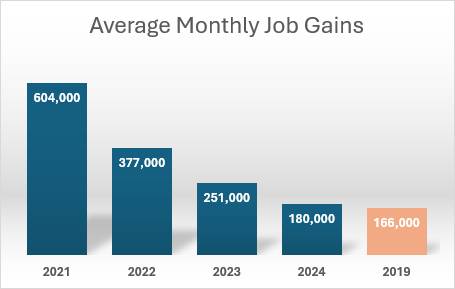

And finally, total jobs created:

And finally, total jobs created:

Total jobs created offers some sign of optimism. While there has been a precipitous drop in monthly job gains since 2021, 2024 averaged 14k more new jobs per month compared to 2019 (before the pandemic hit). However, keep in mind that ~75% of 2024 job growth was concentrated in just three industries (Government, Healthcare, and Leisure & Hospitality). If that optimism is to be felt widespread, we’ll need to see a balancing of job growth.

As far as history rhyming—if we zoom out, we’d see that 2024 numbers were more reflective of pre-pandemic indicators, which leads me to believe 2025 might just feel a bit more “normal.” Job openings are notably down; however, they are ~16% higher than the pre-pandemic average. Our pessimistic view of job openings may be exacerbated by the massive spike in job openings over the past three years. While history might not repeat itself, it’s proven that the pendulum always seems to swing in the other direction. This month’s BLS data (captured in the below “by the numbers”) signifies a stabilization is on the horizon. Notably, we’ve now seen job openings increase for two consecutive months (the first 2 month upward trend since Q2 2022). While two months of data isn’t necessarily enough to signify a reversal in the deteriorating trends that marked much of 2024, the back-to-back increase might signify we’re moving in the right direction.

By the numbers:

- New Jobs – the U.S. added 256,000 new jobs, well above economists’ expectations of 155k.

- The sectors with the strongest job growth were health care & social assistance (+69.5K), retail trade (+43.4K), and leisure & hospitality (+43K).

- The sectors with the largest employment declines were durable goods manufacturing (-16K), wholesale trade (-3.5K), and mining and logging (-3K).

- The US has added an average of 180,000 jobs per month in 2024.

- Unemployment fell to 4.1%, down from 4.2% the previous month.

- The Fed anticipates it’ll hit 4.3% in 2025.

- The first time since 2021 that it has been at or above 4% for seven consecutive months.

- Job openings increased to 8.1 million, up from 7.8 million the previous month.

- Job openings have risen for two straight months, the first such streak since March 2022.

- About 16% above the pre-pandemic level averages.

- Hires remain unchanged at 5.3 million, but down from 5.6 million two months ago.

- Down from 6~ million this time last year.

- Layoffs increased slightly to 1.8 million, up from 1.6 million.

- The layoff rate has stayed at ~1% for 14 consecutive months.

- The number of layoffs remain very low by historical standards.

- Quits decreased to 3.1 million, down from 3.3 million the previous month.

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one continues to remain very steady—and very low.

- Total separations dropped slightly to 5.1 million, down from 5.3 million the previous month.

- Overall, in 2024 separations have stabilized across all industries, notably the tech sector.

- Jobs per available worker held steady for the third consecutive month at 1.1:1.

- Noticeably down from 1.8:1 this time last year.

- This ratio averaged ~2:1 over the past 2 years.

- Labor Force Participation Rate (LFPR) was flat, coming in at 62.5% for the second consecutive month.

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.