New job reports were just released! Here’s our labor market insights for July 2024.

Key Takeaways:

We associate the month of July with fireworks and celebrations. Every year our family lets off a few fireworks in our driveway – nothing major, enough to terrify our dog and annoy my wife; but not enough to impress anyone other than myself. This year, my neighbor (with their annoyingly manicured lawn) did the same thing – and of course, like their lawn and landscaping, theirs were more impressive. If each of the labor sectors were in our cul-de-sac on July 4th, three sectors – Leisure and Hospitality, Government, and Healthcare and Social Assistance – would have been invited to my neighbor’s positive and exciting experience (over 75% of payroll gains occurred in these three sectors). Every other sector would be invited to my largely disappointing display.

The last few months’ data feels like a weather forecast – which forecasted a cold front is coming (a cooling labor market). This month, we started to feel the chill (rising unemployment, slowing job gains, and moderating wage growth). The good news is that we needed the weather to change (we needed stabilization to help curb recessionary concerns). The concern isn’t the temperature, it’s the trend. This month’s data shows the temperature of the labor market is still pleasant, but if current trends continue, the weather could get uncomfortably cold.

By the Numbers:

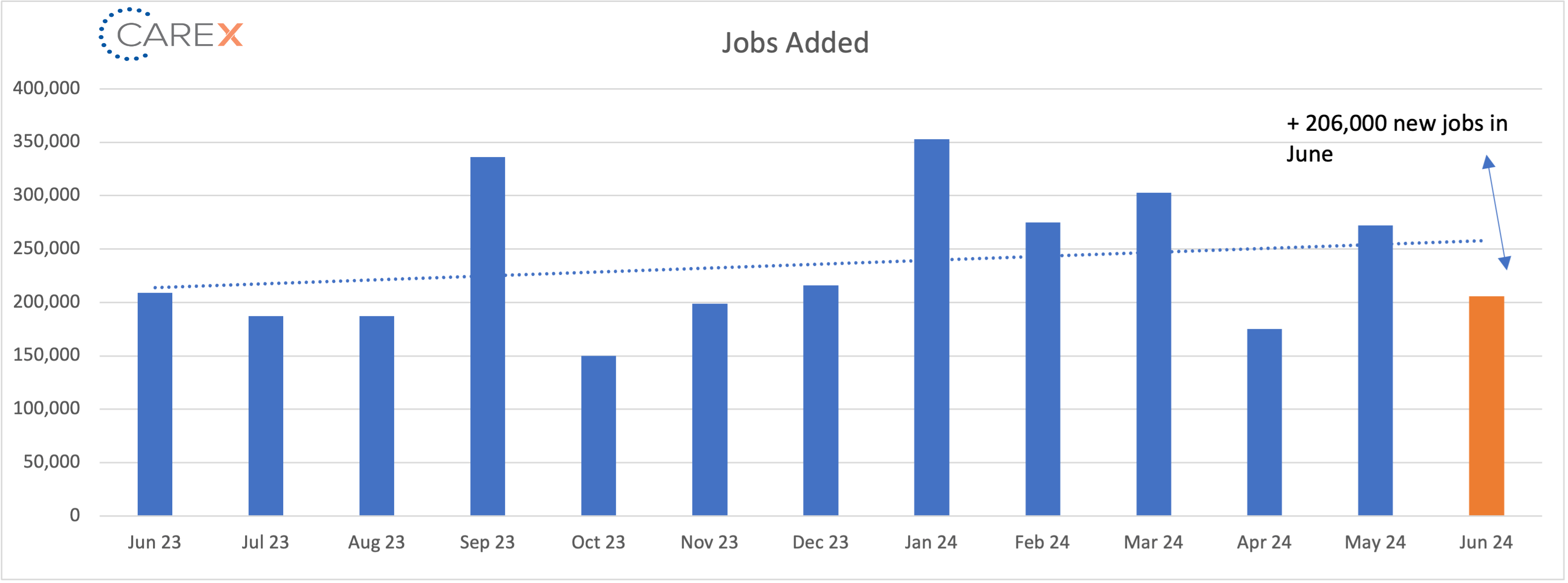

- New Jobs – The U.S. added 206,000 new jobs last month, through the first half of the year, the US has added 1.3 million jobs at an average pace of 222,000 per month.

- The largest chunk of job gains occurred in the public sector, which added a net 70,000 jobs.

- The health care industry added another 48,600 positions.

- Unemployment rose – again – to 4.1%, up from 4% the previous month.

- Inching above 4% for the first time since November 2021.

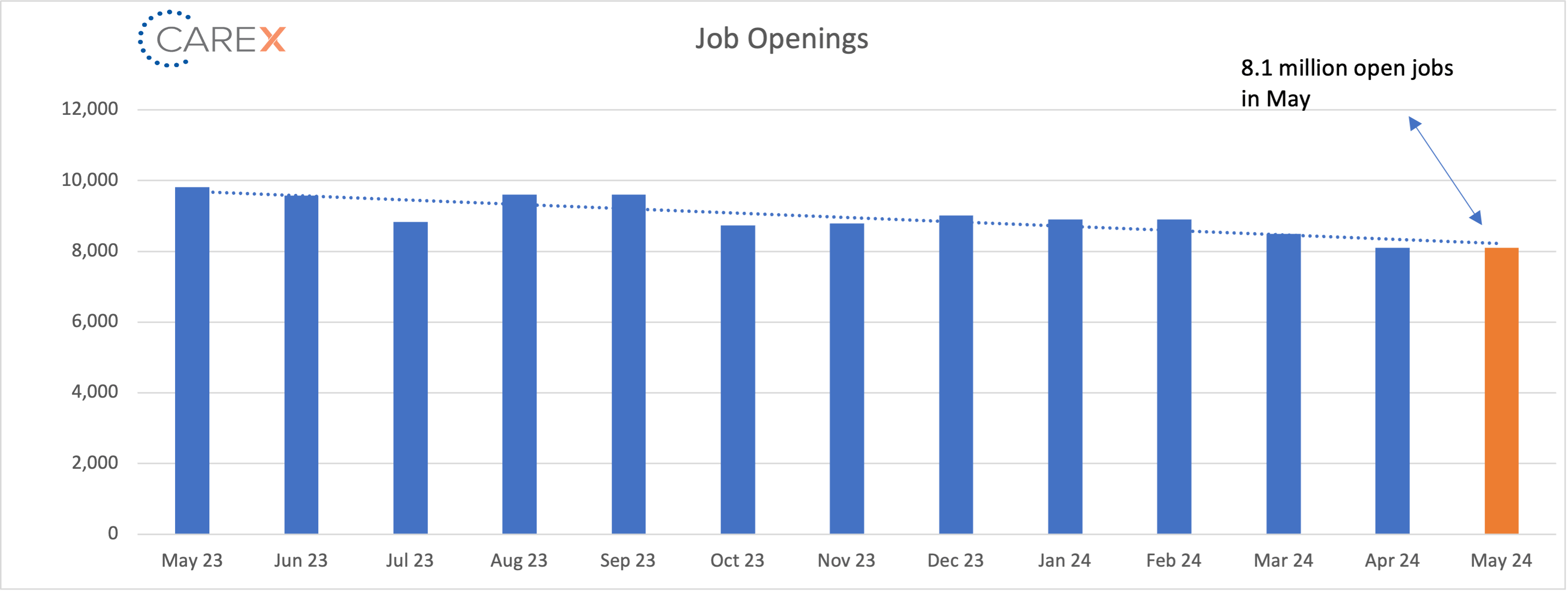

- Job openings remain unchanged at 8.1 million.

- The lowest rate since February 2021.

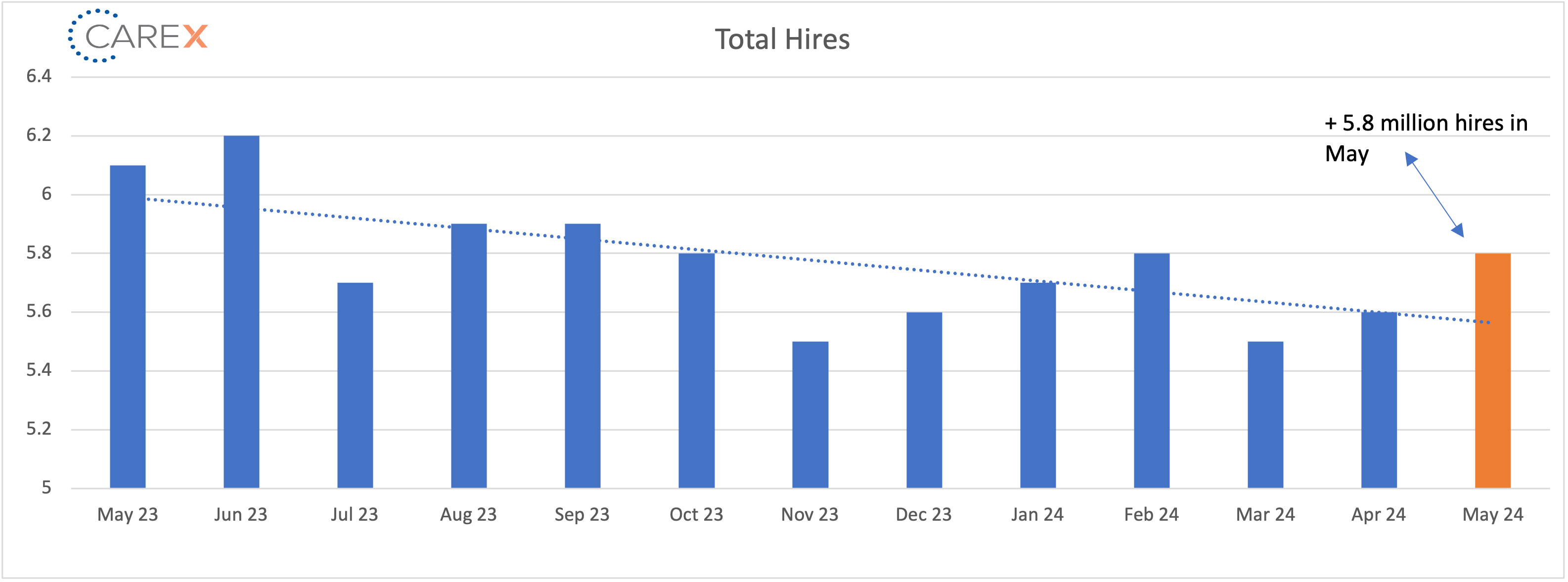

- Hires increased slightly to 5.8 million, up from 5.6 million the previous month, and up from 5.5 million two months ago.

- Down from 6.2 million this time last year.

- Layoffs increased to 1.7 million, up from 1.5 million the previous month.

- The layoff rate stayed at ~1% for the 9th consecutive month.

- The number of layoffs remain very low by historical standards.

- Quits remain unchanged at 3.5 million.

- Quits, which are seen as a measure of worker confidence in the ability to change jobs and find another one continues to remain very steady – and very low.

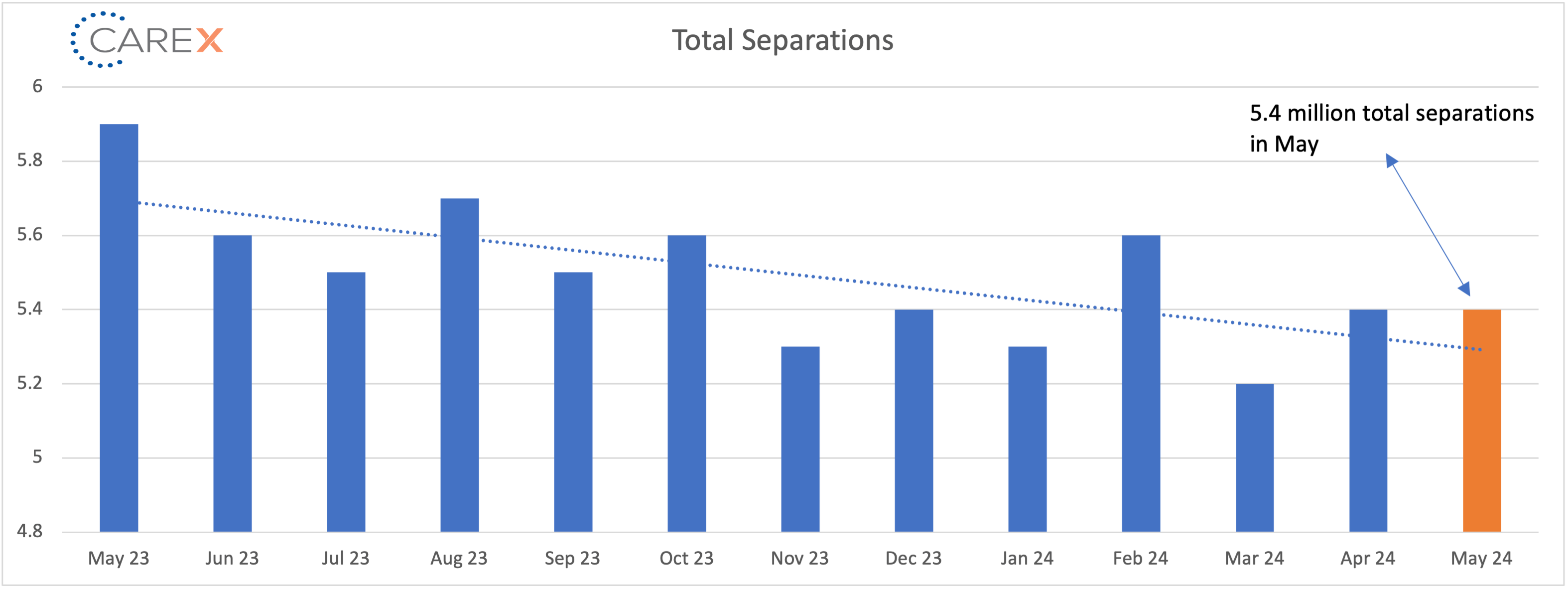

- Total separations remain unchanged at 5.4 million.

- Separations have stabilized across all industries, notably the tech sector.

- Jobs per available worker held at 1.2:1.

- Noticeably down from 1.8:1 last summer.

- This ratio averaged ~2:1 over the past 2-years.

- Labor Force Participation Rate (LFPR) ticked up to 62.5%, up from 62.5% last month.

- It hit a high of 67.3% in early 2000 and fell to 63.3% in the month before the onset of the pandemic.

To make sure you never miss a Labor Market Insights update, you can subscribe to receive reminders via email here! While you’re here, make sure to check out the other resources we have available.